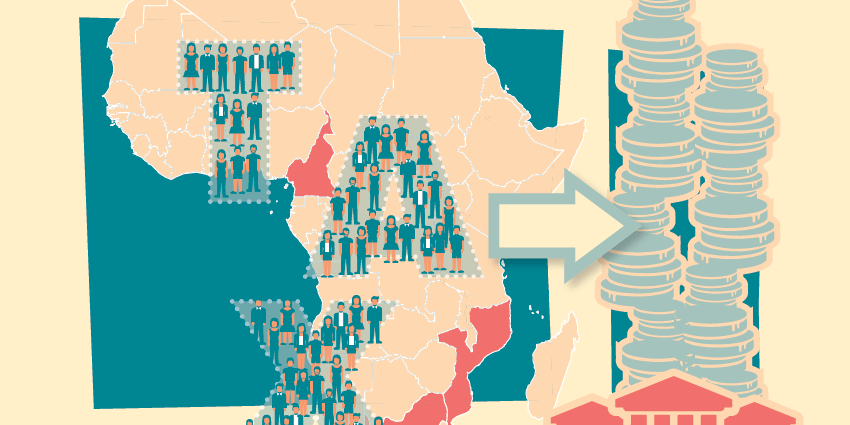

Taxations and State-Society Relations in Sub-Saharan Africa: the cases of Cameroon, Mozambique and South Africa

By Alice Soares Guimarães, Federica Duca and Thatshisiwe Ndlovu

Understanding how revenue collection has functioned historically in three African countries.

Taxation is of central importance to modern societies, as it channels vital issues such as the individual’s obligations to society; the powers and legitimacy of the state; the allocations of public and private resources; the rise of bureaucratic administration; and the reproduction of class, race, ethnic and gender inequalities. This three-year project seeks to understand how revenue collection has functioned historically in South Africa, Cameroon and Mozambique, and the character of state-society fiscal relations in these countries.

DATE: 7 June 2018

Time: 17h30

Venue: Wits Club, West Campus Wits University.