This Friday 23 February, PARI is delighted to host a seminar on state capture with Professor Joel S. Hellman from 13:00 to 15:00. Hellman wrote groundbreaking work on state capture in 2000, focusing on the former Soviet Union: Seize the State, Seize the Day: State Capture, Corruption and Influence in Transition. He is the dean of the Edmund A. Walsh School of Foreign Service. Prior to joining Georgetown in July 2015, Dean Hellman served as the World Bank’s first chief institutional economist. Previously, he directed the World Bank’s Fragile and Conflict Affected States Division. As a development practitioner, Dean Hellman has worked in nearly 50 countries across four continents. He previously taught as a faculty member at Columbia University and Harvard University.

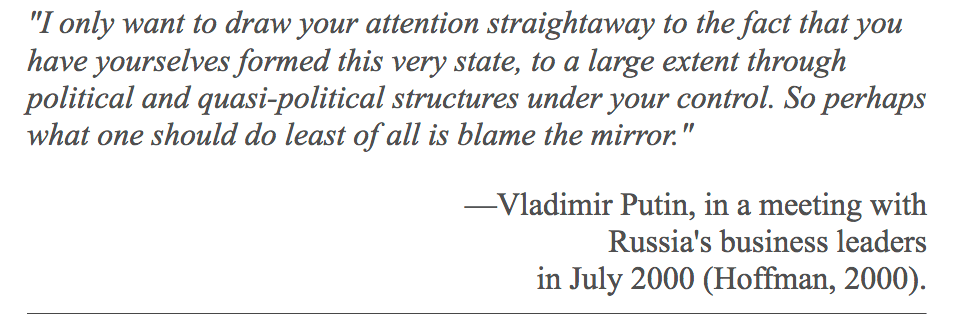

Seize the State, Seize the Day: State Capture, Corruption and Influence

ABSTRACT

The main challenge of the transition has been to redefine how the state interacts with firms, but little attention has been paid to the flip side of the relationship : how firms influence the state – especially how they exert influence on, and collude with public officials to extract advantages. Some firms in transition economies have been able to shape the rules of the game to their own advantage, at considerable social cost, creating what the authors call a “capture economy” in many countries. In the capture economy, public officials, and politicians privately sell under-provided public goods, and a range of rent-generating advantages “a la carte” to individual firms. The authors empirically investigate the dynamics of the capture economy, on the basis of new firm-level data from the 1999 Business Environment and enterprise performance survey (BEEPS), which permits the unbundling of corruption into meaningful, and measurable components. they contrast state capture (firms shaping, and affecting formulation of the rules of the game through private payments to public officials, and politicians) with influence (doing the same without recourse to payments), and with administrative corruption (“petty” forms of bribery in connection with the implementation of laws, rules, and regulations). They develop economy-wide measures for these phenomena, which are then subject to empirical measurement utilizing the BEEPS data. State capture, influence, and administrative corruption are all shown to have distinct causes, and consequences. Large incumbent firms with formal ties to the state tend to inherit influence as a legacy of the past, and tend to enjoy more secure property, and contractual rights, and higher growth rates. To compete against these influential incumbents, new entrants turn to state capture as a strategic choice – not as a substitute for innovation, but to compensate for weaknesses in the legal, and regulatory framework. When the state under-provides the public goods needed for entry and competition, “captor” firms purchase directly from the state, such private benefits as secure property rights, and removal of obstacles to improved performance – but only in a capture economy. Consistent with empirical findings in previous research on petty corruption, administrative corruption – unlike both capture and influence – is not associated with specific benefits for the firm. The focus of reform should be shifted toward channeling firms’ strategies in the direction of more legitimate forms of influence, involving societal “voice”, transparency reform, political accountability, and economic competition, Where state capture has distorted reform to create (or preserve) monopolistic structures, supported by powerful political interests, the challenge is particularly daunting.